04 August 2021

Ad hoc announcement pursuant to Art. 53 listing rules: GAM Holding AG announces first half 2021 results

Financial highlights

- Group assets under management increased to CHF 126.0 billion1 as at 30 June 2021 (compared with CHF 122.0 billion as at 31 December 2020)

- Underlying profit before tax of CHF 0.8 million in the first half of 2021 (compared with underlying loss of CHF 2.0 million in first half of 2020)

- IFRS net loss of CHF 2.7 million (compared with a net loss of CHF 390.1 million in first half of 2020)

- Investment management saw net client outflows of CHF 2.2 billion in the first half of 2021, with private labelling recording net client inflows of CHF 0.8 billion

- 74% of investment management assets under management outperformed their benchmark over five years

Strategic progress

- Distribution footprint now aligned with client demand and growth opportunities

- Responding to client demand with new sustainable investment offerings

- Distribution strategy successfully broadening client interest across investment strategies, with positive flows into equities

- New leadership for private labelling in Luxembourg

- Increased focus on wealth management with appointment of new leadership

- Invested in technology upgrade to support sustainable growth

- On track to deliver CHF 15 million savings for FY 2021

Peter Sanderson, Group CEO, said: “We are committed to sustainable growth at GAM and have invested significantly in talent and technology as well as evolving our product offering to support this.”

“We are seeing an encouraging level of client interest reflecting our strong investment performance and although we saw outflows in investment management overall, we saw net inflows across our equity platform and have achieved an increasingly diversified pipeline of client activity in the first half with demand across our core, thematic, liquid alternative and sustainable strategies.”

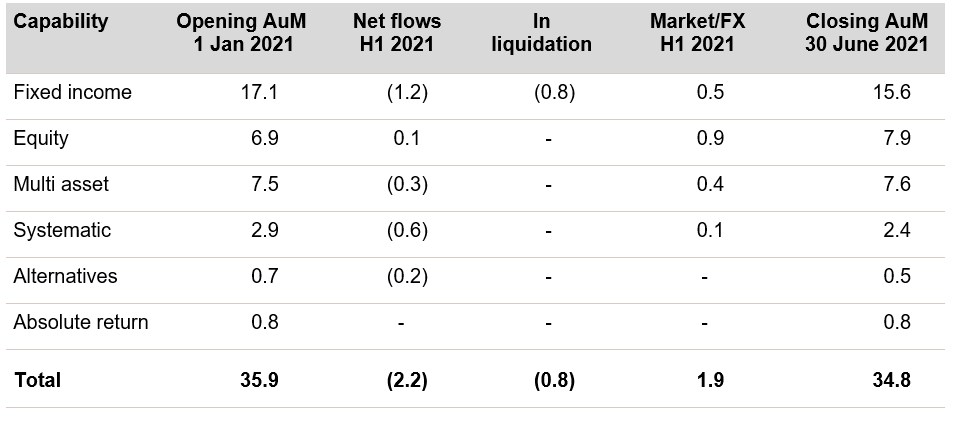

Investment management

- Assets under management totalled CHF 34.8 billion as at 30 June 2021, compared with CHF 35.9 billion as at 31 December 2020

- Net outflows of CHF 2.2 billion were only partly offset by net positive foreign exchange movements and market movements of CHF 1.9 billion in first half of 2021

- While flows were negative in the first half of 2021 after a positive last quarter for 2020, client interaction continues to be encouraging and our pipeline is increasingly diversified across capabilities

- Several equity strategies enjoyed net positive inflows in the first half of 2021, including GAM Star Disruptive Growth, GAM Star European Equity and GAM Luxury Brands Equity

Private labelling

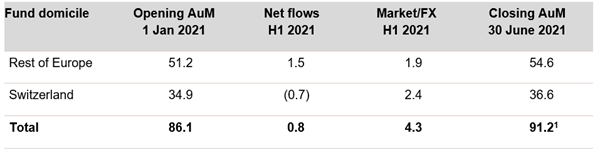

- AuM as at 30 June 2021 totalled CHF 91.2 billion1, compared with CHF 86.1 billion as at 31 December 2020

- Net inflows of CHF 0.8 billion and positive net market and foreign exchange movements of CHF 4.3 billion were recognised in first half of 2021

Investment performance continues to be good

- Over the five-year period to 30 June 2021, 74% of AuM in funds outperformed their respective benchmark, compared with 70% as at 31 December 2020

- Over the three-year period to 30 June 2021, 34% of AuM in funds outperformed their respective benchmark, compared with 23% as at 31 December 2020

- Of GAM’s AuM tracked by Morningstar, 48% and 68% outperformed their respective peer groups over the three- and five-year periods to 30 June 2021, respectively, compared with 56% and 61% as at 31 December 20202

Progress on growth pillar of our strategy

- Strengthened presence in Asia, a strategic growth market for GAM, with the opening of our Singapore office and two new distribution hires

- Appointment of Martin Jufer in the new role of Head of Wealth Management, based in Zurich and Sean O’Driscoll as new Head of Private Labelling Funds and CEO of Luxembourg

- GAM wealth management growth to be driven from our existing base of private clients in Switzerland, the UK and new opportunities in Asia

- New appointments in equity and fixed income investment teams, investment specialist teams and distribution, as well as internal promotions for high-performing talent

Sustainable investing

- Successful launch of the GAM Sustainable Local Emerging strategy with CHF 287 million of assets under management as at 30 June 2021

- New climate bond strategy and a sustainable version of GAM Systematic Core Macro to be launched later this year

- GAM Star Emerging Equity to be repositioned as GAM Sustainable Emerging Equity

- GAM Stewardship Report published with enhanced levels of transparency

- GAM certified as a CarbonNeutral® company for operational emissions

- Joined Net Zero Asset Managers initiative, committing to supporting investing aligned with the goal of net zero by 2050 or sooner

Technology platform upgrade progressing well

- The implementation of a new cloud-based SimCorp platform is core to GAM’s efficiency plan, with decommissioning of legacy systems having begun

- Equity capabilities successfully migrated; by the end of 2021, all our investment portfolios are planned to be on SimCorp, providing a resilient backbone for our operations and the capability to deliver enhanced levels of service and reporting for our clients

- Agile technology successfully rolled out across the firm to facilitate hybrid working and enhance collaboration

- Implementation of Workday, our new Finance and HR platform completed, with legacy systems being decommissioned

- New Multrees technology platform implemented to serve wealth management business

On track to deliver CHF 15 million of cost savings

- Fixed personnel and general expenses of CHF 88.9 million, down CHF 8.8 million from CHF 97.7 million in the first half 2020

- Our full year guidance for 2021 remains unchanged

Assets under management movements (CHF bn)

Net flows by capability

Our fixed income strategies saw net client outflows of CHF 1.2 billion. The majority of these were from our largest strategies, the GAM Local Emerging Bond fund and the GAM Star Credit Opportunities funds. Although the scale of these strategies means that they tend to dominate the picture, we have seen good inflows from our recently launched GAM Sustainable Local Emerging Bond fund and our GAM Star Cat Bond fund.

In equity, net inflows amounted to CHF 0.1 billion and were mainly driven by the GAM Star Disruptive Growth, GAM Star European Equity and GAM Luxury Brands Equity funds. These inflows were partially offset by client redemptions, mainly from the GAM Emerging Markets Equity and GAM Star Japan Leaders funds.

Net outflows from multi asset strategies were CHF 0.3 billion, primarily driven by a redemption from an institutional client.

Alternatives recorded net outflows of CHF 0.2 billion, primarily reflecting outflows from the GAM Select fund.

Systematic saw net outflows of CHF 0.6 billion. This was driven by outflows from the GAM Systematic Core Macro fund.

Absolute return flows remained flat with inflows into the GAM Star EM Rates and GAM Star Alpha Technology funds being offset by redemptions from the GAM Talentum Enhanced Europe Long/Short and the GAM Star Lux Merger Arbitrage funds.

Assets under management movements (CHF bn)

The new Head of Private Labelling, Sean O’Driscoll, will be bolstering our capabilities in Luxembourg, reflecting its importance within GAM’s growth plans. Martin Jufer, the former Head of Private Labelling, will provide continuity by remaining on the boards of GAM’s management companies in Switzerland, Luxembourg, Ireland and Italy in addition to his new role as Global Head of Wealth Management. As at 30 June 2021, AuM increased to CHF 91.2 billion1 from CHF 86.1 billion at the end of FY 2020, with net inflows of CHF 0.8 billion and net positive market and foreign exchange movements of CHF 4.3 billion.

Net fee and commission income increased by 1% to CHF 125.1 million compared with CHF 123.8 million in H1 2020. This was primarily driven by an increase in net performance fees from CHF 0.8 million in H1 2020 to CHF 17.3 million for H1 2021 due to good performance in GAM Star Disruptive Growth and systematic strategies.

Personnel expenses decreased by 3% to CHF 77.9 million in 2021 from CHF 80.2 million in H1 2020. Fixed personnel costs decreased by 12%, driven by lower headcount. Headcount stood at 652 FTEs as at 30 June 2021 compared with 701 FTEs as at the end of December 2020 and 747 FTEs at the end of June 2020.

Variable compensation increased to CHF 22.9 million from CHF 17.6 million in H1 2020, mainly due to an increase in performance fees which result in an increase in contractual bonus amounts.

General expenses totalled CHF 33.9 million, down 3% from CHF 35.1 million in the corresponding period last year.

The operating margin stood at 3.6%, compared with negative 0.6% in H1 2020, mostly as a result of higher performance fees and a further reduction in expenses.

The underlying pre-tax profit was CHF 0.8 million, up from a CHF 2.0 million underlying pre-tax loss in H1 2020. This was also driven by higher performance fees and a further reduction in expenses.

The underlying tax expense for the first half of 2021 was CHF 3.1 million, compared with CHF 1.5 million in H1 2020. This was driven by expenses which are not tax deductible, losses at non-taxable entities and losses at entities which are not expected to reverse in the near future.

Diluted underlying losses per share were CHF 0.01, up from a loss of CHF 0.02 in H1 2020.

The IFRS net loss was CHF 2.7 million in the first half of 2021 compared with a net loss of CHF 390.1 million in the corresponding period last year. The loss in the first half of 2020 was mainly driven by the full impairment of legacy goodwill (CHF 374 million), which was primarily created by the acquisition of GAM by Julius Baer in 2005 and UBS in 1999.

Cash and cash equivalents as at 30 June 2021 were CHF 250.1 million, down from CHF 270.9 million as at 31 December 2020. The reduction was driven by annual bonuses paid in the first half of 2021 relating to 2020 and changes in accruals and other balance sheet items.

Adjusted tangible equity as at 30 June 2021 was CHF 196.2 million, compared with CHF 188.7 million at the end of last year. The increase was partly driven by the remeasurement of the pension liability.

We expect the market environment to remain challenging but believe that we are well positioned to service client demand across a broad range of products. Our financial targets remain unchanged, reflecting our belief in the potential of our business and the scalability of the platform that we have built.

The presentation for analysts and investors of the H1 2021 results of GAM Holding AG will be webcast on 4 August 2021 at 8:30am (CEST). A presentation for media will be webcast at 10:00am (CEST). Materials relating to the results (presentation slides, 2021 Half Year Report and press release) are available at www.gam.com.

| 21 October 2021 | Q3 2021 Interim Management Statement |

| 17 February 2022 | Full Year Results 2021 |

| 20 April 2022 | Q1 2022 Interim Management Statement |

| Charles Naylor Global Head of Communications and Investor Relations T +44 20 7917 2241 |

|

| Investor Relations Jessica Grassi T +41 58 426 31 37 |

|

| Media Relations Ute Dehn Christen T+41 58 426 31 36 |

Media Relations Kathryn Jacques T +44 20 7393 8699 |

Visit us at: www.gam.com

Follow us on: Twitter, LinkedIn

About GAM

GAM is a leading independent, pure-play asset manager. The company provides active investment solutions and products for institutions, financial intermediaries and private investors. The core investment business is complemented by private labelling services, which include management company and other support services to third-party asset managers. GAM employed 652 FTEs in 15 countries with investment centres in London, Cambridge, Zurich, Hong Kong, New York, Milan and Lugano as at 30 June 2021. The investment managers are supported by an extensive global distribution network. Headquartered in Zurich, GAM is listed on the SIX Swiss Exchange with the symbol ‘GAM’. The Group has AuM of CHF 126.0 billion1 (USD 136.3 billion) as at 30 June 2021.

Disclaimer regarding forward-looking statements

This press release by GAM Holding AG (‘the Company’) includes forward-looking statements that reflect the Company’s intentions, beliefs or current expectations and projections about the Company’s future results of operations, financial condition, liquidity, performance, prospects, strategies, opportunities and the industry in which it operates. Forward-looking statements involve all matters that are not historical facts. The Company has tried to identify those forward-looking statements by using words such as ‘may’, ‘will’, ‘would’, ‘should’, ‘expect’, ‘intend’, ‘estimate’, ‘anticipate’, ‘project’, ‘believe’, ‘seek’, ‘plan’, ‘predict’, ‘continue’ and similar expressions. Such statements are made on the basis of assumptions and expectations which, although the Company believes them to be reasonable at this time, may prove to be erroneous.

These forward-looking statements are subject to risks, uncertainties, assumptions and other factors that could cause the Company’s actual results of operations, financial condition, liquidity, performance, prospects or opportunities, as well as those of the markets it serves or intends to serve, to differ materially from those expressed in, or suggested by, these forward-looking statements. Important factors that could cause those differences include, but are not limited to: changing business or other market conditions, legislative, fiscal and regulatory developments, general economic conditions, and the Company’s ability to respond to trends in the financial services industry. Additional factors could cause actual results, performance or achievements to differ materially. The Company expressly disclaims any obligation or undertaking to release any update of, or revisions to, any forward-looking statements in this press release and any change in the Company’s expectations or any change in events, conditions or circumstances on which these forward-looking statements are based, except as required by applicable law or regulation.